- TOP

- Sustainability

- Governance: Enhancing Corporate Governance

Enhancing Corporate Governance

The CITIZEN Group’s Corporate Governance

The CITIZEN Group endeavors to improve corporate value and contribute to society through sustained activities that are in harmony with the local community and the global environment. This is part of its corporate philosophy, after which the company was named: "Loved by citizens, working for citizens." To continuously improve corporate value, we are striving to reinforce corporate governance in recognition of the importance of ensuring management transparency and supervising management from various angles.

The CITIZEN Group strives to further enhance its corporate governance to ensure sustainable growth through the achievement of the Group's overall business goals. With the global economy and society changing at an unprecedented pace, CITIZEN WATCH is playing a central role in managing and supervising the entire Group to respond to the various social issues we face.

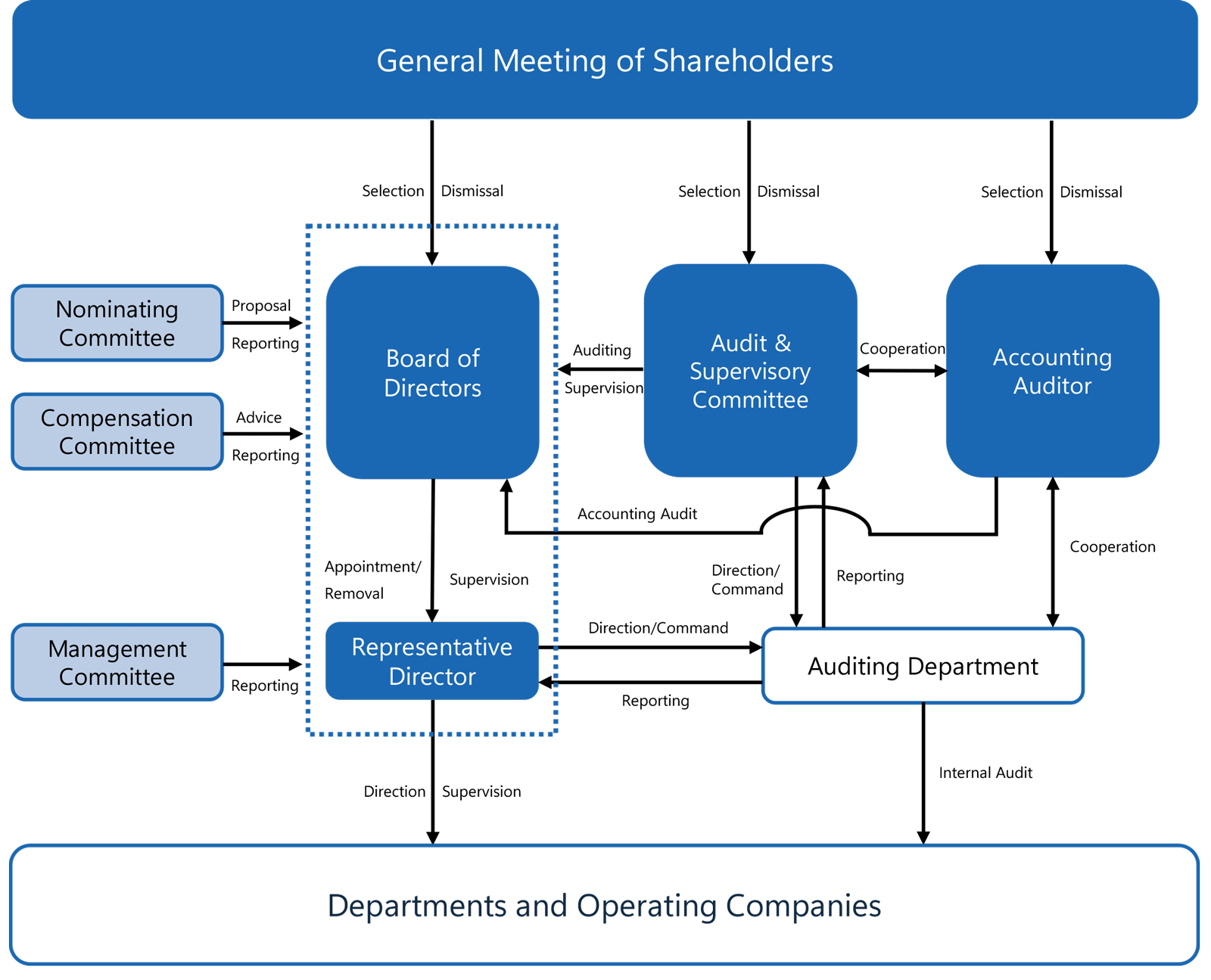

Corporate Governance Structure

CITIZEN WATCH has adopted the system of a company with an audit and supervisory committee. Its Board of Directors comprises 10 members in total: four directors (excluding directors who are Audit & Supervisory Committee members) who are very versed in the company’s businesses, three highly independent outside directors (excluding directors who are Audit & Supervisory Committee members), one director who is a full-time Audit & Supervisory Committee member, and two highly independent outside directors who are Audit & Supervisory Committee members. The board decides on and supervises the company’s business execution.

The Audit & Supervisory Committee comprises three members: one director who is a full-time Audit & Supervisory Committee member and two outside directors who are full-time Audit & Supervisory Committee members. The committee audits the company’s business execution.

CITIZEN WATCH has also established the Nomination Committee and the Compensation Committee as voluntary bodies to enhance management transparency.

The main duties of the Nomination Committee are to deliberate and propose to the Board of Directors matters concerning the selection or dismissal of the representative director, the president and CEO, and the chairperson of the Board of Directors; to deliberate and report in consultation with the Board of Directors or the president and CEO or other directors concerning the selection or dismissal of officers; and to deliberate and report in consultation with the Board of Directors or the president and CEO or other directors concerning succession planning for the president and CEO and directors.

The Compensation Committee discusses matters related to the policy and the standards for compensation for directors (excluding directors who are Audit & Supervisory Committee members), and its main duty is also to provide advice and counsel to the Board of Directors.

Each of these two committees is composed of three or more directors, who are appointed by a resolution of the Board of Directors. The majority of committee members are outside directors, and at least one of them is a representative director. Both committees are chaired by an outside director elected by the committee members.

The directors who are Audit & Supervisory Committee members rigorously audit business execution by directors in accordance with the audit policy and audit plans formulated by the committee by attending Board of Directors meetings, Management Committee meetings, and business-specific meetings, inspecting important documents, such as authorization documents and reports from directors and others on the execution of duties, and conducting operational and asset surveys. They also receive reports on accounting audits from Nihombashi Corporation, the company’s accounting auditor, and cooperate with the auditor to efficiently perform audit and other tasks for CITIZEN WATCH and its subsidiaries in order to further enhance corporate governance.

- * Seven directors (including three outside directors; excluding directors who are Audit & Supervisory Committee members) / three Audit & Supervisory Committee members (including two outside directors)

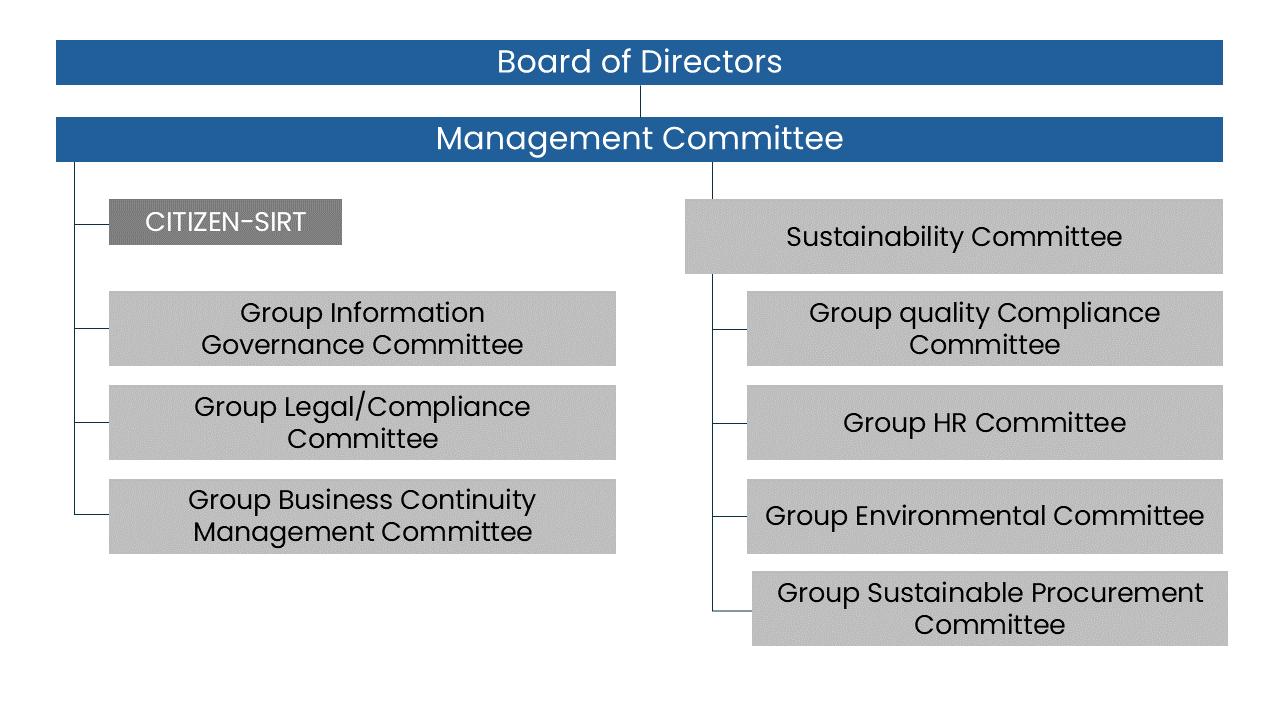

Committees

To ensure the achievement of business goals and the sustainable development of the entire CITIZEN Group, we have formulated the Group Risk Management Basic Policy, the Group Risk Management Basic Regulations, and the Group Crisis Management Basic Regulations. These rules aim to achieve centralized risk management and prompt responsiveness, thus actively promoting the enhancement of Group governance.

Moreover, we have established committees in accordance with business operations, including the CITIZEN-SIRT (CITIZEN-Security Incident Response Team) for responding to significant incidents such as information leaks, and the Group Quality Compliance Committee for addressing quality-related compliance risks. Through these committees, we are actively advancing efforts to strengthen corporate governance and enhance management transparency.

Board Composition and Diversity

CITIZEN WATCH is committed to ensuring that the Board of Directors effectively fulfills its roles and responsibilities in achieving management strategies, taking into consideration diversity in terms of gender, nationality, etc. To this end, the company has defined the areas in which directors are expected to have knowledge, experience, and abilities, including not only "corporate management and management strategy," "sales and marketing," "technology, development, and production," "finance and accounting," and "legal affairs and risk management" but also "global management," "IT and DX," "HR development and diversity," and "ESG and sustainability." Directors are appointed on such conditions as that they meet the requirements for a director stipulated in the Companies Act and other laws and regulations, have the character and insight appropriate for a director, and are capable of fulfilling their responsibilities.

As of June 25, 2025, independent outside directors accounted for 50% of the Board of Directors, and female directors accounted for 30%.

Assessment of Board Effectiveness

CITIZEN WATCH conducted an assessment and analysis of the effectiveness of the Board of Directors to further strengthen its functions. The results indicated that the Board of Directors is effectively functioning, with a focus on operations, agenda, and structure, and that its effectiveness is ensured.

- 1. Assessment method

-

To analyze and evaluate the effectiveness of the Board of Directors, we are conducting a questionnaire every year regarding the Board of Directors for all directors and corporate auditors, using an effectiveness evaluation tool developed by an external organization. This year’s questionnaire was administered using questions developed by an external organization, and it included questions related to self-assessment. After implementation, the results of the analysis and evaluation were reviewed by the Board of Directors.

- Questionnaire respondents: All directors and corporate auditors (11 persons)

- Period: February 27 to March 7, 2025

-

Questionnaire content: 15 questions in total

- Section 1: Two questions about the operation of the Board of Directors

- Section 2: Eight questions about the agenda of the Board of Directors

- Section 3: Two questions about the structure supporting the Board of Directors

- Section 4: Three questions about self-assessment

- 2. Summary of the results

-

The results of the Assessment of Board Effectiveness questionnaire have revealed that the directors and corporate auditors generally rated the Board of Directors high in their answers, confirming that the Board was found to be functioning effectively and that its effectiveness was ensured. In their answers to the respective sections of questions, the respondents assessed the effectiveness of the Board as follows.

-

- Operation of the Board of Directors

-

The respondents’ answers included that necessary information is provided in an appropriate amount, while preparatory materials are distributed with ample time for advance reading, and that for complex agenda items, advance explanations are given, and additional materials are distributed.

-

- Agenda of the Board of Directors

-

The respondents' answers included that opinions are exchanged to achieve management goals, while important issues are actively discussed, with objections sometimes raised, by many inside and outside directors and that opinions are exchanged about capital costs and stock prices, with a focus placed on improving capital efficiency.

The respondents' answers to the question about internal controls included that the Board is promoting the enhancement of the operational aspects of internal controls. The respondents’ answers to the question about sustainability included that many years of efforts have ingrained sustainability in the company as a corporate culture, with healthy business activities conducted in conformity to the corporate philosophy. The respondents’ answers to the question about DX included that positive efforts to promote DX have resulted in improvements therein and progress in the development of DX human resources.

-

- Structure Supporting the Board of Directors

-

The respondents' answers included that information is appropriately provided to the Board members, including information on the respective businesses' actions, such as issuing their monthly overview reports and holding technology exhibitions, as well as regular updates provided by the IR and PR Departments.

The respondents' answers to the question about training included that ample opportunities are provided for the Board members to acquire knowledge and raise their own awareness through external seminars made available to them.

-

Compensation of Directors and Audit & Supervisory Committee Members

Compensation for CITIZEN WATCH directors (excluding directors who are Audit & Supervisory Committee members and outside directors) consists of performance-linked and non-performance-linked compensation, etc. Compensation for outside directors and directors who are Audit & Supervisory Committee members consists solely of fixed compensation.

CITIZEN WATCH maintains a policy to set officer compensation at a level that facilitates the motivation for performance improvement and securing excellent personnel, taking into account changes in the business environment, external data, industry standards, and management content. Decisions about executive bonuses are determined based on financial benchmarks (such as sales and operating profit) and non-financial benchmarks (such as the world situation, disasters, and M&A) in addition to this policy.

The purpose of performance-linked stock compensation is to establish a clearer link between compensation for directors (excluding directors who are Audit & Supervisory Committee members) and the stock value of CITIZEN WATCH, enhancing awareness of contributing to medium- to long-term performance improvement and increased corporate value. The company has adopted the policy of determining compensation at a level that makes such objectives achievable. Starting from FY2022, the CO2 emissions reduction rate and FTSE Russell ESG Scores, both of which are ESG indicators, have also been added to evaluation metrics. We have included MARS (mutually agreed registration scheme) and clawback provisions, which permit us to request a reduction in or return of compensation in the event of misconduct by a director, aiming to prevent improper conduct by directors and curb excessive risk-taking.

Please scroll down to see→

| Classification | Number of payees | Total amount paid (million yen) | Amount of fixed compensation (million yen) | Amount of bonus (million yen) | Amount of performance-linked stock compensation (million yen) |

|---|---|---|---|---|---|

| Directors (outside directors among the above) |

9 (3) | 332 (32) | 166 (32) | 93 (-) | 62 (-) |

| Audit & Supervisory Committee members (outside members among the above) |

3 (2) | 49 (29) | 49 (29) | - (-) | - (-) |

| Total (Total for those outside among the above) |

12 (5) | 371 (61) | 215 (61) | 93 (-) | 62 (-) |

- The above figures include directors who retired upon the conclusion of the 139th Ordinary General Meeting of Shareholders, held on June 25, 2024.

- Bonuses of 93 million yen to directors (excluding outside directors) are the amount to be paid after the conclusion of the 140th Ordinary General Meeting of Shareholders, to be held on June 25, 2025.

- The performance-linked stock compensation of 62 million yen for directors (excluding outside directors and directors who are non-residents of Japan) is the amount as expenses for the fiscal year under review.

- To promote motivation in contributing to the enhancement of single-year and medium- to long-term performance and the improvement of corporate value, the performance indicators for bonuses are consolidated net sales and consolidated operating profit margin in the annual plan, in addition to consolidated net sales, consolidated operating profit margin, and the ROE in the Medium-Term Management Plan. The actual results during the fiscal year under review were consolidated net sales of 316.885 billion yen, a consolidated operating profit margin of 6.5%, and an ROE of 9.5%. Bonuses were calculated by multiplying the base monthly compensation for each position by a coefficient determined by the level of achievement of performance indicators and nonfinancial items.

- Performance-linked stock compensation is paid with shares in the Company, and the conditions for allotment and other related matters are as stated in "(1) Policies, etc. on determination of officer compensation, etc." in "3. Compensation for Directors and Corporate Auditors" of the 140th CITIZEN GROUP Report. Furthermore, the status of delivery is as stated in the 140th CITIZEN GROUP Report "II. MATTERS CONCERNING COMPANY STOCK AND SHARE ACQUISITION RIGHTS, ETC. 1. Condition of Stocks (as of March 31, 2025) (5) Status of shares delivered to officers of the Company as compensation for the performance of the duties during the fiscal year under review." In order to further clarify the linkage between the compensation for directors and the share value of the Company to promote motivation in contributing to the enhancement of medium- to long-term performance and the improvement of corporate value, the performance indicators for performance-linked stock compensation are consolidated sales, consolidated operating profit margin, ROE, CO2 reduction rate (compared to 2018) and FTSE Russell ESG Scores related to the medium-term management plan. The actual results during the fiscal year under review were consolidated net sales of 316.885 billion yen, a consolidated operating profit margin of 6.5%, an ROE of 9.5%, CO2 emission reduction rate (compared to 2018) of 43.4% and a FTSE Russell ESG Score of 4.2. Performance-linked stock compensation was calculated according to the level of the achievement of performance indicators, etc.

- The maximum allowance for the total amount of compensation, etc. for directors (excluding outside directors) was set at 370 million yen per year (inclusive of bonuses, etc.) at the 133rd Ordinary General Meeting of Shareholders, held on June 27, 2018, and the number of directors (excluding outside directors) as of the conclusion of that Ordinary General Meeting of Shareholders was eight (8). Employee salaries for employees who also serve as directors shall not be paid.

- Separate from note 6 above, at the 133rd Ordinary General Meeting of Shareholders, held on June 27, 2018, the total amount of performance-linked stock compensation for directors (excluding outside directors and directors who are non-residents of Japan) was set at not more than 300 million yen every three fiscal years (starting in 2018, the first year, at no more than 100 million yen), and the number of directors (excluding outside directors and directors who are non-residents of Japan) as of the conclusion of that Ordinary General Meeting of Shareholders was eight (8).

- The maximum allowance for the total amount of compensation, etc. for outside directors was set at 40 million yen per year at the 134th Ordinary General Meeting of Shareholders, held on June 26, 2019, and the number of outside directors as of the conclusion of that Ordinary General Meeting of Shareholders was three (3). No bonuses shall be paid to outside directors.

- The maximum allowance for the total amount of compensation, etc. for Audit & Supervisory Board members was set at 80 million yen per year at the 122nd Ordinary General Meeting of Shareholders, held on June 26, 2007, and the number of Audit & Supervisory Audit members as of the conclusion of that Ordinary General Meeting of Shareholders was three (3). No bonuses shall be paid to corporate auditors.

- In order to increase the transparency concerning the compensation of directors, the Company delegated the determination of the content of individual compensation, etc. of directors for the fiscal year under review to the Compensation Committee, chaired by Outside Director Mr. Katsuhiko Yoshida and with Outside Directors Ms. Toshiko Kuboki and Mr. Yoshio Osawa and President and CEO Mr. Toshihiko Sato as members. The Compensation Committee found that the content of the individual compensation, etc. of directors for the fiscal year under review is in line with the Policy on the Determination of the Content of Individual Compensation, etc. of Directors because the determination of the content was delegated to the Compensation Committee by a resolution of the Board of Directors, and the content of compensation, etc. conforms with said policy resolved by the Board of Directors.

- 11: With regard to notes 6 to 9 above, in conjunction with our transition to a company with an audit and supervisory committee, the 140th Ordinary General Meeting of Shareholders, held on June 25, 2025, resolved as follows:

- The maximum allowance for the total amount of compensation, etc. for directors (excluding directors who are Audit & Supervisory Committee members) was set at 340 million yen per year (including 70 million yen per year for outside directors) at the 140th Ordinary General Meeting of Shareholders, held on June 25, 2025, and the number of directors (excluding directors who are Audit & Supervisory Committee members) as of the conclusion of that Ordinary General Meeting of Shareholders was seven (7). Employee salaries for employees who also serve as directors shall not be paid. No bonuses shall be paid to outside directors.

- Separate from the above, at the 140th Ordinary General Meeting of Shareholders, held on June 25, 2025, the total amount of performance-linked stock compensation for directors (excluding directors who are Audit & Supervisory Committee members, outside directors, and directors who are non-residents of Japan) was set at the product of multiplication of 180 million yen by the number of fiscal years relevant to the Medium-term Management Plan. The number of directors (excluding directors who are Audit & Supervisory Committee members, outside directors, and directors who are non-residents of Japan) as of the conclusion of that Ordinary General Meeting of Shareholders was four (4). The total amount of performance-linked stock compensation, etc. includes compensation for our executive officers. As of the conclusion of that Ordinary General Meeting of Shareholders, the number of executive officers who do not concurrently serve as directors was 11.

- The maximum allowance for the total amount of compensation, etc. for directors who are Audit & Supervisory Committee members was set at 70 million yen per year at the 140th Ordinary General Meeting of Shareholders, held on June 25, 2025, and the number of directors who are Audit & Supervisory Committee members as of the conclusion of that Ordinary General Meeting of Shareholders was three (3).

List of Directors and Corporate Auditors

CITIZEN WATCH strives to appoint outside directors and outside Audit & Supervisory Committee members who are free from any possibility of conflict of interest with general shareholders, emphasizing their abundant experience and broad insight as management staff or their advanced knowledge and insight in corporate finance, corporate legal affairs, and other areas.

The areas of knowledge, experience, and abilities required to effectively fulfill the roles and responsibilities of the Board of Directors in achieving management strategies are defined and disclosed in the skills matrix.

Please scroll down to see→

| Name | Position | Attendance at Board of Directors meetings | |

|---|---|---|---|

| Toshihiko Sato | President & CEO | - | 17 / 17 (100%) |

| Toshiyuki Furukawa | Managing Director | In charge of the Corporate Planning Department, Accounting Department, Public Relations & Investor Relations Office, and Information Systems Department | 17 / 17 (100%) |

| Yoshitaka Oji | Managing Director | Senior General Manager of Watch Business Division | 17 / 17 (100%) |

| Yoshiaki Miyamoto | Director | General Manager of General Affairs Division and in charge of Group Risk Management, Personnel Division, CSR Department, and Environmental Management Department | 17 / 17 (100%) |

| Hideo Ina | Director | - | 13 / 13 (100%) |

| Toshiko Kuboki | Outside Director | - | 17 / 17 (100%) |

| Yoshio Osawa | Outside Director | - | 17 / 17 (100%) |

| Katsuhiko Yoshida | Outside Director | - | 17 / 17 (100%) |

| Noboru Akatsuka | Full-time Audit & Supervisory Board member Outside Audit & Supervisory Board member |

- | 17 / 17 (100%) |

| Kazunori Yanagi | Full-time Audit & Supervisory Board member | - | 17 / 17 (100%) |

| Yaeko Ishida | Outside Director | - | 17 / 17 (100%) |

- * All Audit & Supervisory Board members attended all 13 meetings of the Audit & Supervisory Board held during the 140th term (FY2024).

- * Ms. Yaeko Ishida works as an attorney-at-law under the name of "Yaeko Kitadai."

- * As of March 31, 2025

Attendance at Meetings

Please scroll down to see→

| Name | Nomination Committee | Compensation Committee | ||

|---|---|---|---|---|

| No. of attendances | Attendance rate (%) | No. of attendances | Attendance rate (%) | |

| Toshiko Kuboki | 6 | 100 | 2 | 100 |

| Yoshio Osawa | 6 | 100 | 2 | 100 |

| Katsuhiko Yoshida | 6 | 100 | 2 | 100 |

| Toshihiko Sato | 6 | 100 | 2 | 100 |

Skill matrix of Directors

The skills possessed by each director are as follows:

Please scroll down to see→

| Position and name | Gender | Corporate Management / Management Strategy | Sales / Marketing | Technology / Development / Manufacturing | Global management | IT/DX | HR Development / Diversity | Finance / Accounting | ESG / Sustainability | Legal Affairs / Risk Management |

|---|---|---|---|---|---|---|---|---|---|---|

| President and CEO Yoshitaka Oji |

Male | ● | ● | ● | ● | ● | ||||

| Senior Managing Director Toshiyuki Furukawa |

Male | ● | ● | ● | ● | ● | ● | |||

| Managing Director Yoshiaki Miyamoto |

Male | ● | ● | ● | ● | ● | ● | |||

| Director Keiichi Kobayashi |

Male | ● | ● | ● | ● | ● | ||||

| Outside Director Toshiko Kuboki |

Female | ● | ● | ● | ||||||

| Outside Director Yoshio Osawa |

Male | ● | ● | ● | ●; | ● | ● | |||

| Outside Director Katsuhiko Yoshida |

Male | ● | ● | ● | ● | ● | ||||

| Director Full-time Audit & Supervisory Committee Member Kazunori Yanagi |

Male | ● | ● | ● | ● | ● | ||||

| Outside Director Audit & Supervisory Committee Member Yaeko Ishida |

Female | ● | ● | |||||||

| Outside Director Audit & Supervisory Committee Member Noriko Yamanaka |

Female | ● | ● |

- * This does not represent all of the knowledge and experience possessed by each director.

- * Ms. Yaeko Ishida uses the name Yaeko Kitadai in her profession as an attorney-at-law.

Reasons for Appointment of Outside Directors

Toshiko Kuboki

We have reappointed Ms. Toshiko Kuboki as an outside director in the expectation that she will utilize her professional perspective as an attorney and her experience as an outside director to check and oversee the Company’s management and to supervise the processes of selecting the President and CEO and determining executive compensation, etc., from an independent and objective standpoint. Although she has never been involved in the management of a company except as an outside director or outside corporate auditor, we have appointed her as she is well versed in corporate legal affairs as an attorney and judging that she can appropriately execute her duties as an outside director.

Yoshio Osawa

We have reappointed Mr. Yoshio Osawa as an outside director with the expectation of utilizing his abundant experience and broad insight as a businessperson to check and supervise the Company's management, as well as to supervise the process of selecting the President and CEO, and determining executive compensation, etc. from an independent and objective standpoint.

Katsuhiko Yoshida

We have reappointed Mr. Katsuhiko Yoshida as an outside director with the expectation of utilizing his abundant experience and broad insight as a businessperson to check and supervise the Company's management, as well as to supervise the process of selecting the President and CEO, and determining executive compensation, etc. from an independent and objective standpoint.

Yaeko Ishida

We have determined that she is well qualified to be a director who is an Audit & Supervisory Committee member on the basis that she has abundant experience and insight as an attorney-at-law and will be capable of utilizing the expert perspective she has as an attorney-at-law in the Company’s audits. Although she has never been involved in the management of a company except as an outside director or outside corporate auditor, we have appointed her as a director who is an Audit & Supervisory Committee member since we have determined that she is well versed in corporate legal affairs as an attorney and is capable of appropriately executing her duties as a director who is an Audit & Supervisory Committee member.

- * Ms. Yaeko Ishida works as an attorney-at-law under the name of "Yaeko Kitadai."

Noriko Yamanaka

We have determined that she is well qualified to be a director who is an Audit & Supervisory Committee member on the basis that she has abundant experience and insight as a certified public accountant and will be capable of utilizing the expert perspective she has as a certified public accountant in the Company’s audits. Although she has never been involved in the management of a company except as an outside director or outside corporate auditor, we have appointed her as a director who is an Audit & Supervisory Committee member since we have determined that she is well versed in corporate accounting and internal controls as a certified public accountant and is capable of appropriately executing her duties as a director who is an Audit & Supervisory Committee member.

Training for Directors and Audit & Supervisory Committee Members

As opportunities for training in line with the Corporate Governance Code, in FY2025, CITIZEN WATCH provided all directors and Audit & Supervisory Committee members, including those outside, with online training, where they attended lectures on the necessary themes of their choice. E-learning and collective training programs were provided to Group companies’ directors and Audit & Supervisory Committee members newly appointed this fiscal year.