- TOP

- Investor Relations

- Action to Implement Management that is Conscious of Cost of Capital and Stock Price

Action to Implement Management that is Conscious of Cost of Capital and Stock Price

Action to Implement Management that is Conscious of Cost of Capital and Stock Price

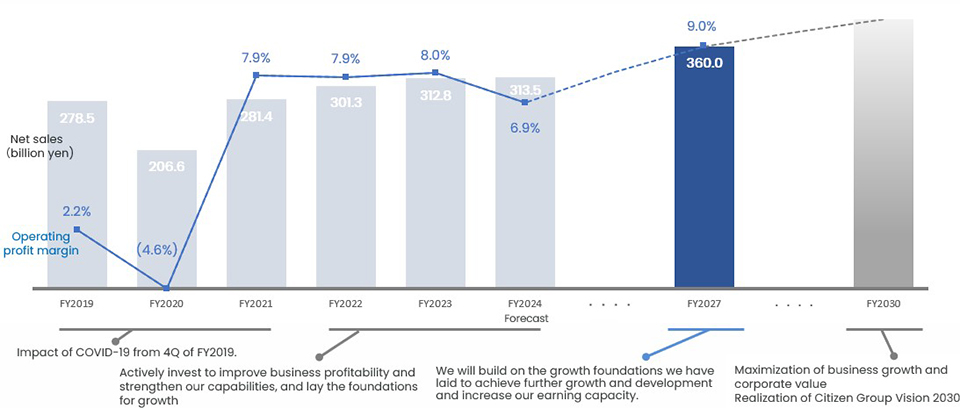

The Company has long been holding a series of discussions on management that appropriately control the balance sheet at its Board of Directors, being conscious of cost of capital and the stock price.

The main policies and initiatives of the Company in the Medium-Term Management Plan 2027(FY2025 to FY2027)announced in April 25, 2025 are as folliws.

Numerical targets FY2027

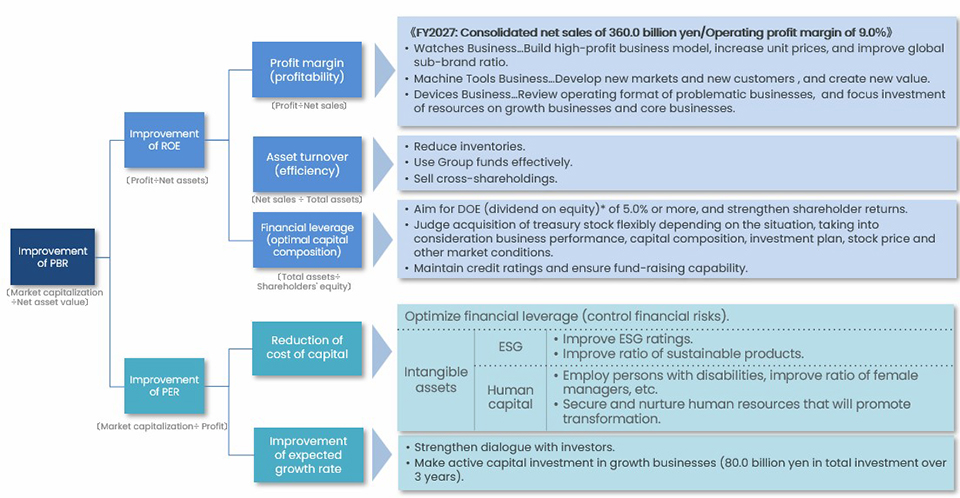

Implement management that is conscious of PBR and investment in growth and rationalization.

(1)Management that is conscious of PBR (price-to-book ratio)

(2)Execution of growth strategies (investment for growth and rationalization)

|

Watches |

■Make investments to increase production capacity and productivity in response to plan for increased production of mechanical movements. ■Seek to strengthen brand presence and improve profitability through investment in D2C e-commerce sites, which are an important distribution channel for brand expression. |

|

Watches |

■Make investments to increase production capacity and productivity in response to plan for increased production of mechanical movements. ■Seek to strengthen brand presence and improve profitability through investment in D2C e-commerce sites, which are an important distribution channel for brand expression. |

|

Machine Tools |

■Utilize the production infrastructure put in place during period of Medium-term Management Plan 2024, strengthen sales and support capabilities by increasing staff at sales bases, etc. and, alongside work flow improvements and effective system operation, make investments for sales expansion. ■Make investments for expansion of AI-based next-generation models and automated and labor-saving services. |

|

Machine Tools |

■Utilize the production infrastructure put in place during period of Medium-term Management Plan 2024, strengthen sales and support capabilities by increasing staff at sales bases, etc. and, alongside work flow improvements and effective system operation, make investments for sales expansion. ■Make investments for expansion of AI-based next-generation models and automated and labor-saving services. |

|

Devices and Components |

■Make investments for increased production, automation and improved productivity in businesses with growth potential such as ceramics, motors and photo printers. |

|

Devices and Components |

■Make investments for increased production, automation and improved productivity in businesses with growth potential such as ceramics, motors and photo printers. |

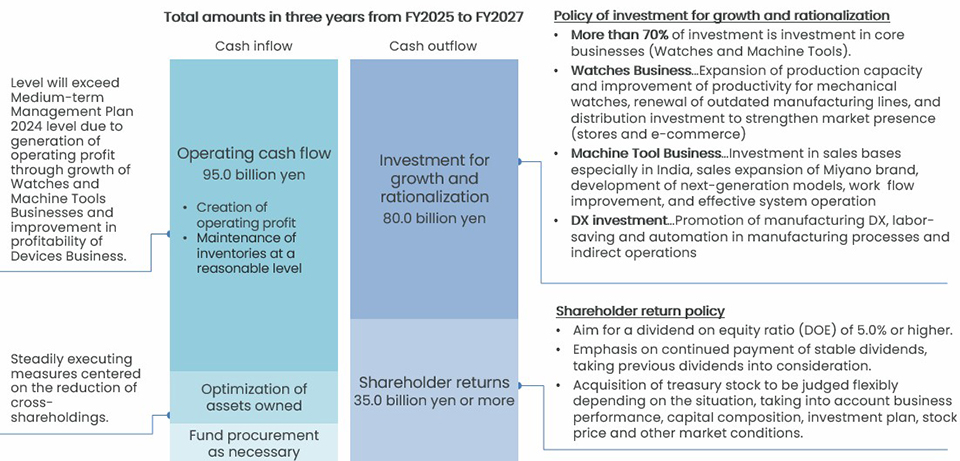

Cash allocation

Shareholder return policy (FY2025-2027)

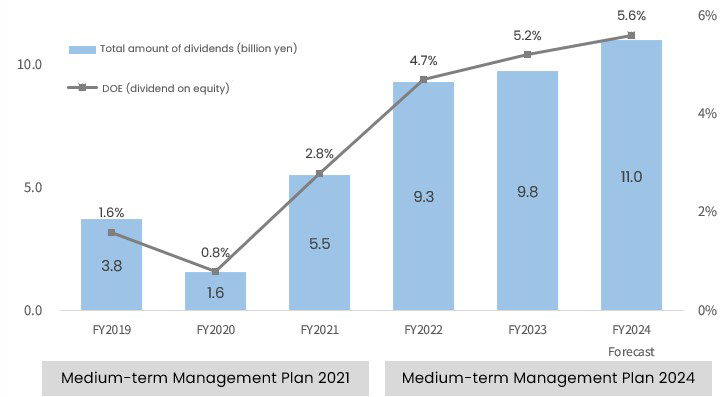

・Aim for DOE (dividend on equity)* of 5.0% or more

・Emphasis on continued payment of stable dividends, taking previous dividends into consideration.

・Acquisition of treasury stock to be judged flexibly depending on the situation, taking into account business performance, capital composition, investment plan, stock price and other market conditions.

* DOE = “Total amount of dividends” /Shareholders' equity (average of amounts at beginning and end of fiscal year)"

■Previous dividends

For enhancement of corporate value (PBR)